4 4: Compute a Predetermined Overhead Rate and Apply Overhead to Production Business LibreTexts

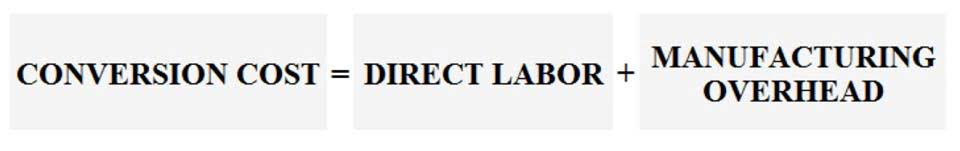

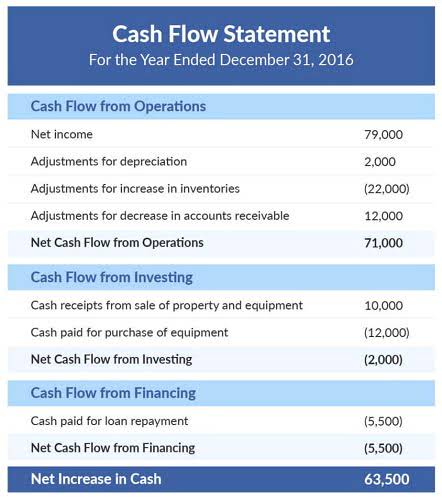

It is worked out by dividing the estimated amount of overhead by the estimated value of the base before actual production commences. It is applied for the absorption of overheads during the period for which they have been computed. Direct costs are costs directly tied to a product or service that a company produces. Direct costs include direct labor, direct materials, manufacturing supplies, and wages tied to production. To calculate the predetermined overhead rate, the marketing agency will need to add up all of its estimated overhead costs for the upcoming year. The overhead cost per unit from Figure 6.4 is combined with the direct material and direct labor costs as shown in Figure 6.3 to compute the total cost per unit as shown in Figure 6.5.

Predetermined Overhead Rate Basis

Additionally, you should recalculate your predetermined overhead rate any time there is a significant change in your business, such as the addition of new equipment or a change in your product line. Again, this predetermined overhead rate can also be used to help the business owner estimate their margin on a product. The business owner can then add the predetermined overhead costs to the cost of goods sold to arrive at a final price for the candles. This predetermined overhead rate can be used to help the marketing agency price its services.

Accounting Ratios

- We monitor rates from banks and credit unions daily to help you feel confident before you open a new account.

- Overhead is then applied by multiplying the pre-determined overhead rate by the actual driver units.

- Also, it’s important to compare the overhead rate to companies within the same industry.

- The overhead rate has limitations when applying it to companies that have few overhead costs or when their costs are mostly tied to production.

For example, let’s say the marketing agency quotes a client $1,000 for a project that will take 10 hours of work. The agency knows from its predetermined overhead rate that it will incur $200 in overhead costs for the project. By understanding how to calculate this rate, business owners can better control their overhead costs and make more informed pricing decisions.

Applying the Overhead Rate

A predetermined overhead rate is often an annual rate used to assign or allocate indirect manufacturing costs to the goods it produces. Manufacturing overhead is allocated to products for various reasons including compliance with U.S. accounting principles and income tax regulations. Small companies tend to use activity-based costing, whereas in larger companies, each department in which different processes of production take place typically computes its own predetermined overhead rate. Hence, the overhead incurred in the actual production process will differ from this estimate. A predetermined overhead rate is an allocation rate given for indirect manufacturing costs that are involved in the production of a product (or several products). To calculate a predetermined overhead rate, divide the manufacturing overhead cost by the units of allocation.

PRODUCT GALLERY

The overhead will be allocated to the product units at the rate of 10.00 for each machine hour used. After reviewing the product cost and consulting with the marketing department, the sales prices were set. The sales price, cost of each product, and resulting gross profit are shown in Figure 6.6. Also, if the rates determined are nowhere close to being accurate, the decisions based on those rates will be inaccurate, too. The allocation base (also known as the activity base or activity driver) can differ depending on the nature of the costs involved. That’s because a certificate of deposit requires you to « lock in » your money for a predetermined amount of time ranging from three months to five years.

- The best way to predict your overhead costs is to track these costs on a monthly basis.

- The agency knows from its predetermined overhead rate that it will incur $200 in overhead costs for the project.

- A predetermined overhead rate (pohr) is use to calculate the amount of manufacturing overhead which is to be applied to the cost of a product.

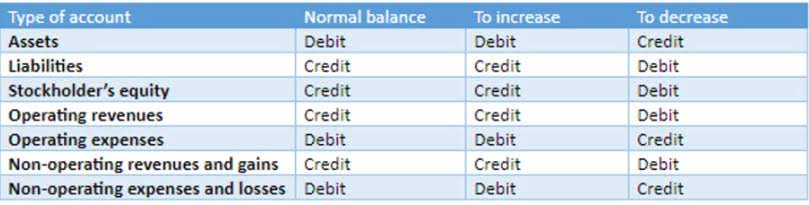

- Finally, you would divide the indirect costs by the allocation measure to achieve how much in overhead costs for every dollar spent on direct labor for the week.

- At the end of the accounting period the applied overhead is compared to the actual overhead and any difference is posted to the cost of goods sold or, if significant, to work in process.

- The overhead rate allocates indirect costs to the direct costs tied to production by spreading or allocating the overhead costs based on the dollar amount for direct costs, total labor hours, or even machine hours.

- It is important to include indirect costs that are based on this overhead rate in order to price a product or service appropriately.

Need repairs or a questions about a new door?

- It is often difficult to assess precisely the amount of overhead costs that should be attributed to each production process.

- In recent years increased automation in manufacturing operations has resulted in a trend towards machine hours as the activity base in the calculation.

- » It’s not often I take time to commend someone for their services, but this seemed like a rare case of excellent service, quality and professionalism. »

- Enter the total manufacturing overhead cost and the estimated units of the allocation base for the period to determine the overhead rate.

Using the planned annual amounts for the upcoming year reduces the fluctuations that would occur if monthly rates were used. Let’s assume a company has overhead expenses that total $20 million for the period. If a job in work in process has recorded predetermined overhead rates actual machine hours of 140 for the accounting period then the predetermined overhead applied to the job is calculated as follows. The allocation of overhead to the cost of the product is also recognized in a systematic and rational manner.

1 Calculate Predetermined Overhead and Total Cost under the Traditional Allocation Method

- Because of this decrease in reliance on labor and/or changes in the types of production complexity and methods, the traditional method of overhead allocation becomes less effective in certain production environments.

- This activity base is often direct labor hours, direct labor costs, or machine hours.

- The best 5-year CDs will offer lower rates than the other terms on our list, but are still popular options for investors.

- That’s because a certificate of deposit requires you to « lock in » your money for a predetermined amount of time ranging from three months to five years.